AI for insurance

The end-to-end AI automation platform built for insurance

From submission intake and quote comparison to claims processing and portfolio management, we streamline every step of the insurance life cycle.

Designed for brokers, MGAs and carriers, our agentic workflows adapt fully to your underwriting, claims, and operational processes. Purpose-built insurance workflows with unlimited flexibility to shape them to your needs.

Scale your insurance expertise

Our agents process complex submissions, policies and claims at scale, so underwriting and claims teams can focus their expertise where it has the greatest strategic and client impact.

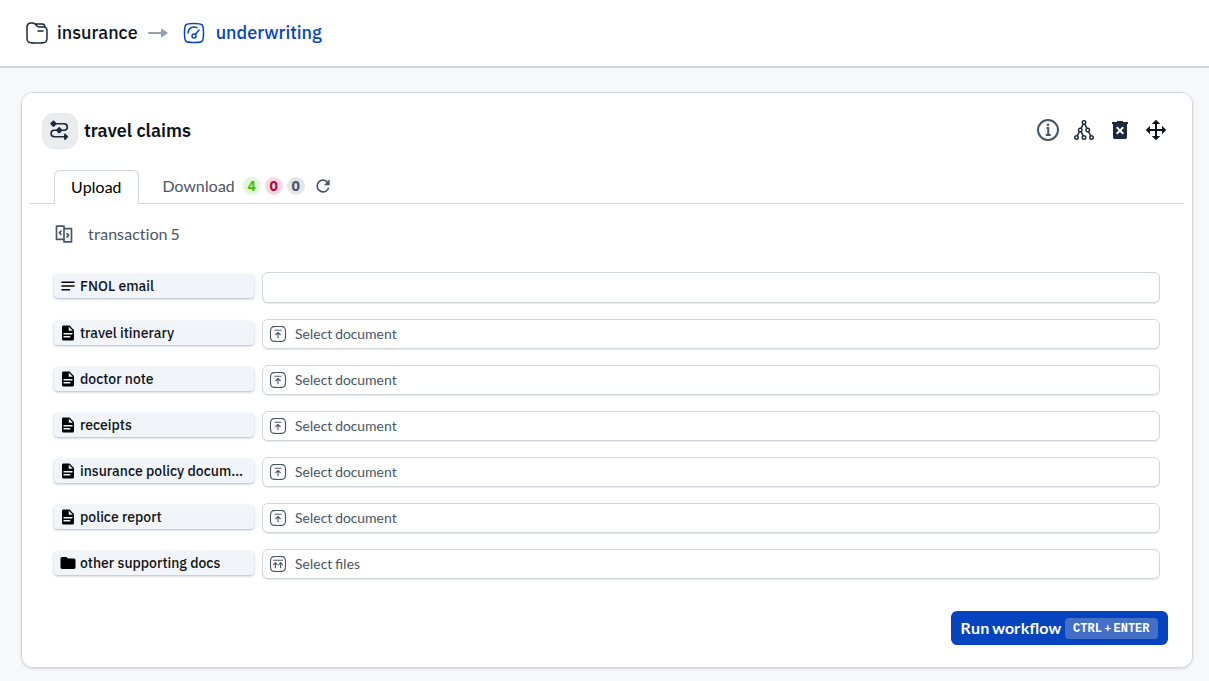

Submission intake and triage

Reduce time-to-quote and improve quote hit ratio

Let us handle submission intake and analysis of documents such as ACORD forms, SOVs, loss runs or draft policies. We prioritize submissions which are aligned with your risk appetite, underwriting guidelines and portfolio composition, so underwriters can focus on quotes with the highest likelihood of winning.

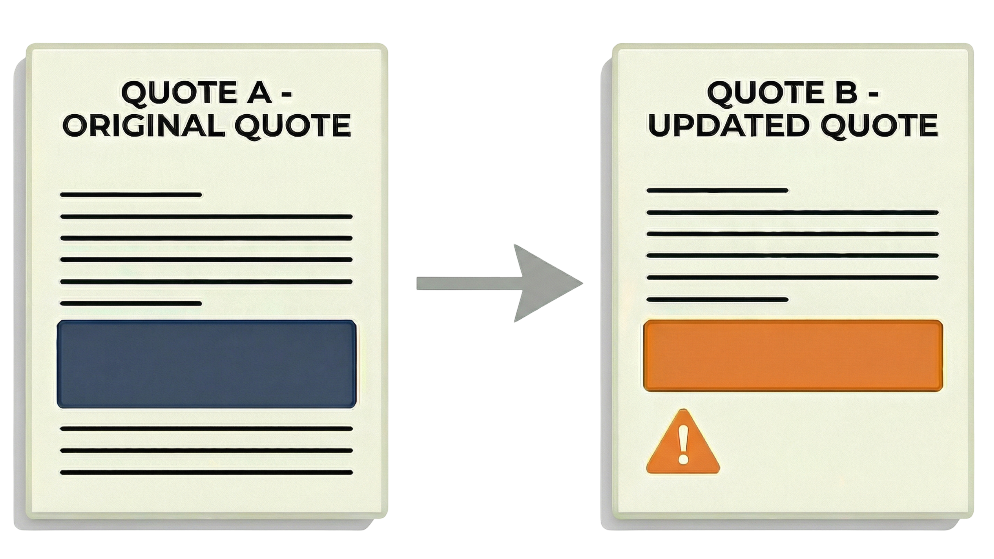

Quote / Policy check and comparison

Ensure quote consistency and speed up quote reviews

Validate quotes with underwriting guidelines and historical policies to ensure underwriting consistency and risk appetite alignment. Compare multiple quotes, validate coverage, limits, deductibles, exclusions and warranties, and identify the most suitable one.

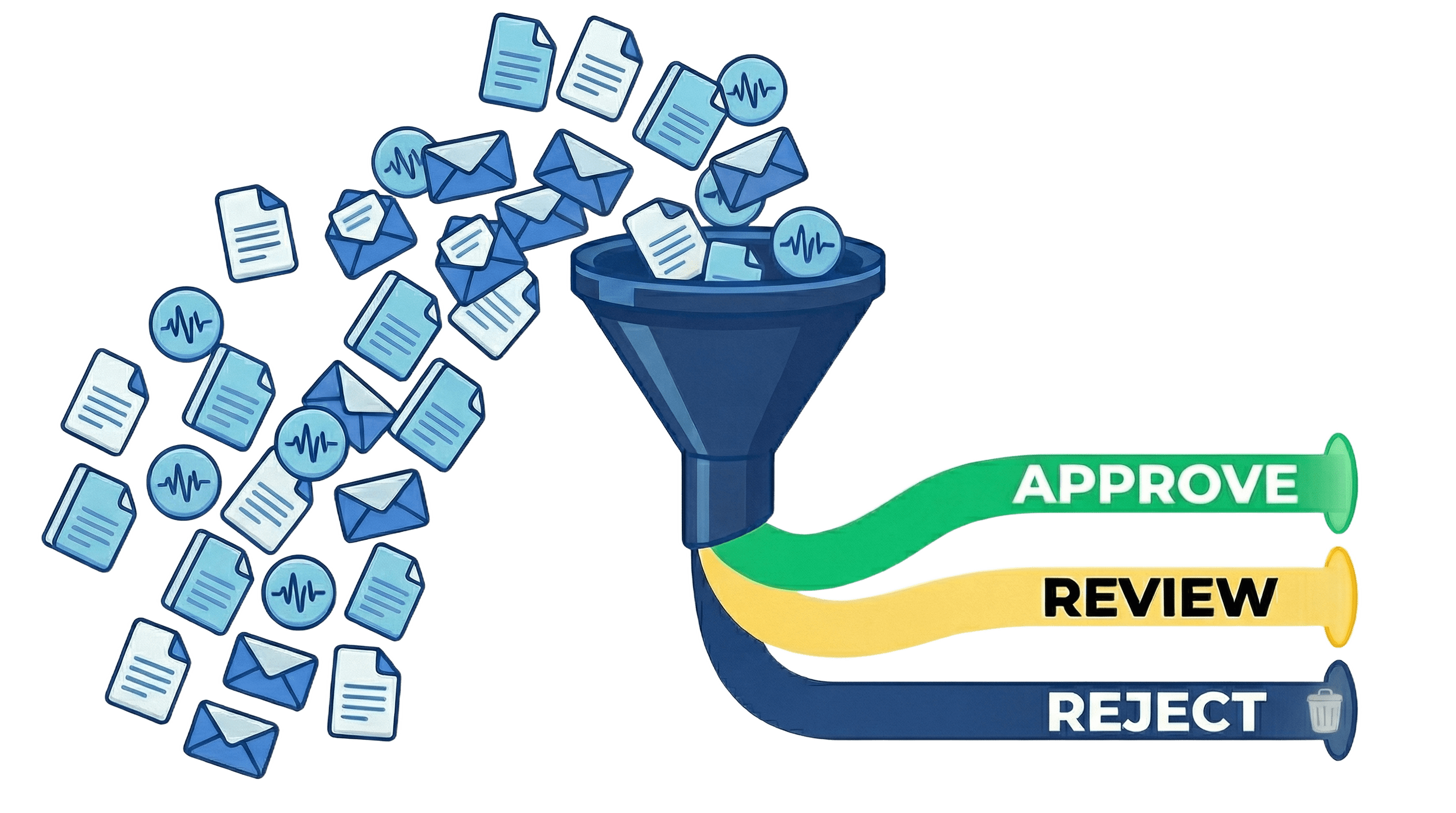

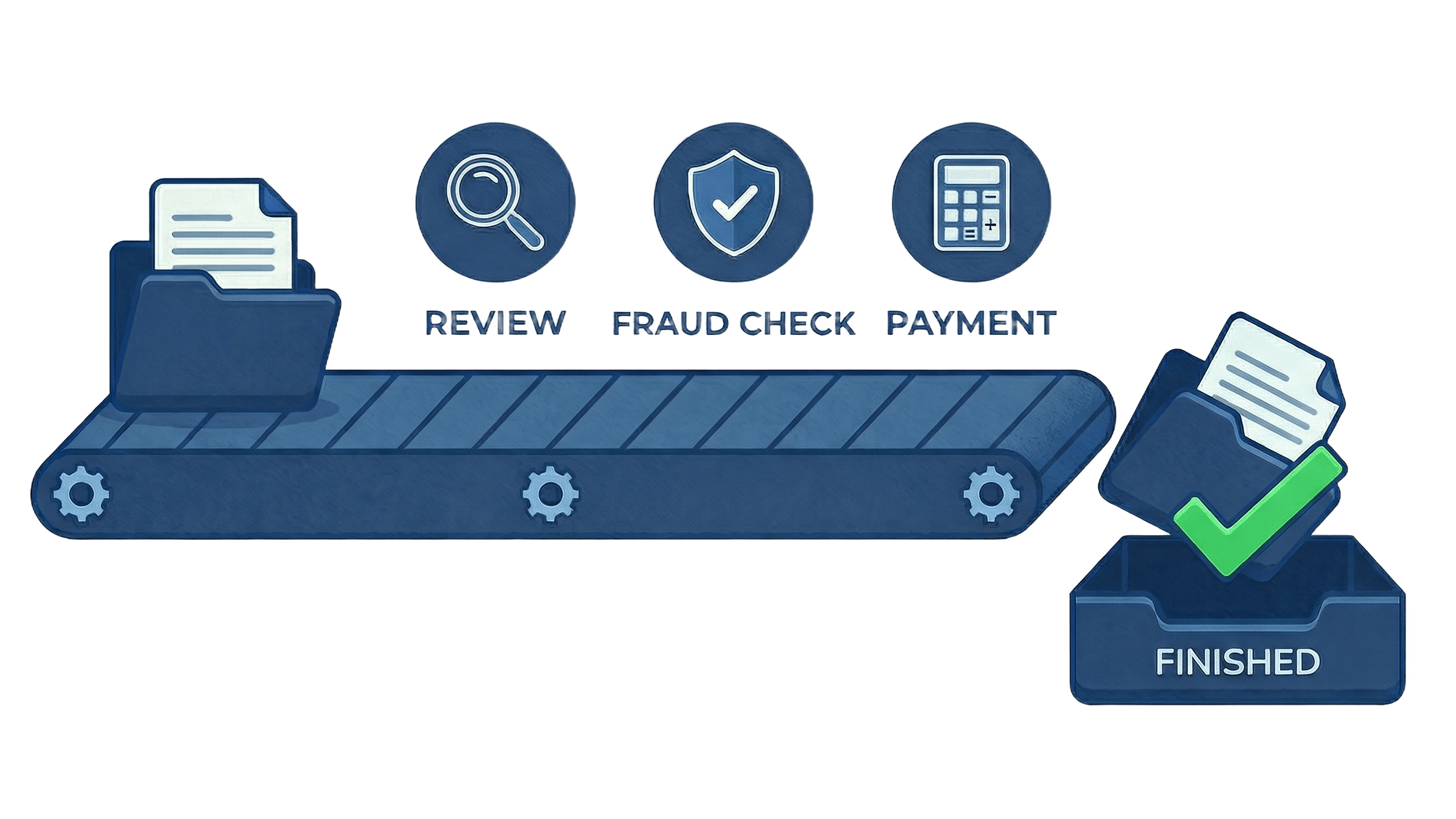

Claims processing

Real-time, accurate processing of high-volume claims

High-volume claims such as travel or motor benefit drastically from automated straight-through processing. Faster claims handling means happier customers and frees up your team to focus on complex cases.

Portfolio analysis

Improve risk selection with real-time portfolio analysis

Our root-cause analysis agent monitors your portfolios 24/7 and identifies the key drivers behind loss ratios in real-time, helping claims and underwriting to optimize portfolio performance.

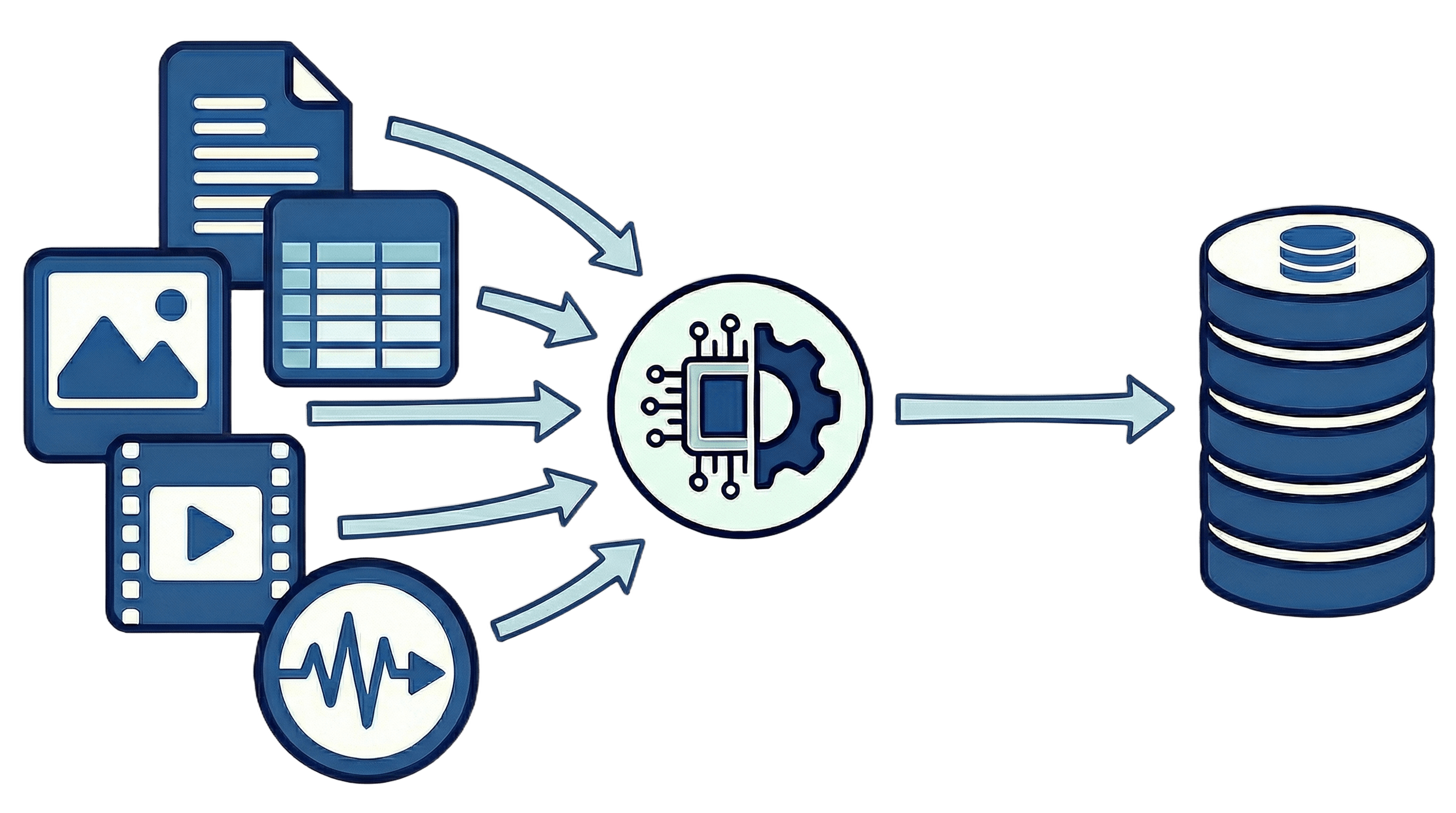

Data management

Turn messy submission and claims data into a strategic asset

Easily clean and extract information from unstructured submission, claims and policy data. The resulting datasets can be re-used across all your processes, complete with audit trails, versioning and time travel for all agentic AI steps.

Ready to transform your insurance operations?

See how Decision Computing can help you automate underwriting, claims processing, and operational workflows while maintaining transparency and compliance.

Legal

Privacy policyGet the latest product news and updates.